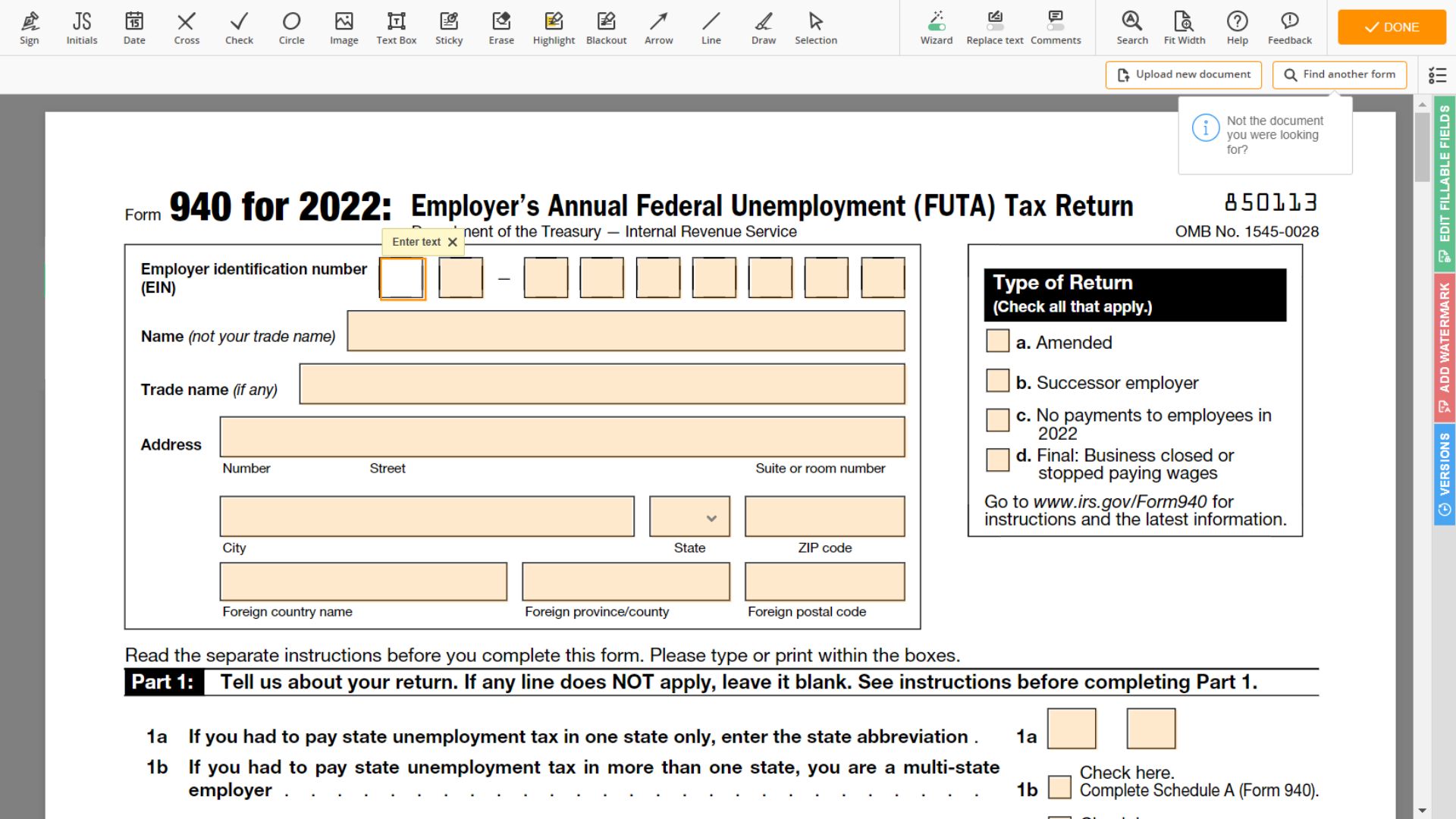

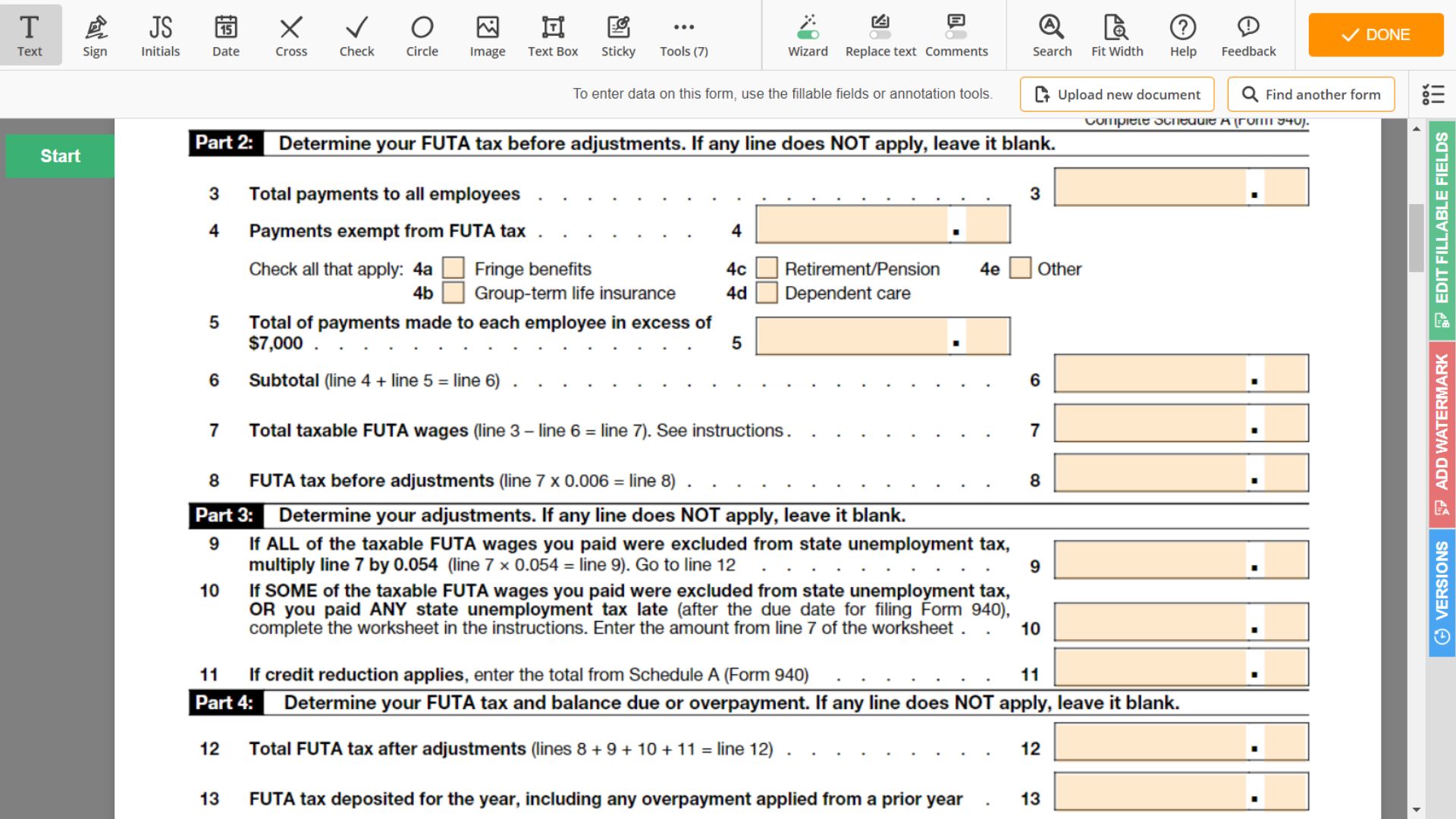

IRS Form 940 is an annual federal tax return that employers must submit to the Internal Revenue Service (IRS). It is used to report the amount of federal unemployment taxes (FUTA) that an employer has withheld from their employee’s wages during the year. This form also allows employers to apply for any credits they may be eligible for.

For those unfamiliar with federal 940 tax form and its instructions, 940formirs.org offers an invaluable resource. Our website has detailed instructions on how to complete the form, as well as several examples of completed forms. These materials make it much easier for employers to understand how to fill out the blank 940 form and ensure that their taxes are calculated correctly. With these materials, employers can save time and money by avoiding costly errors and making sure that all of their tax information is accurate and up to date.

Who Must File IRS Form 940 for 2023

Every employer in the United States must file the 940 form to the local IRS, the federal agency responsible for taxation. The form is an annual report of the federal unemployment tax, which employers pay. Filing the form is mandatory for all employers. However, there are certain exemptions.

The exemptions for filing and filing the 940 form are as follows:

- Employers who paid wages of less than $1,500 in any calendar quarter

- Employers who had no more than 10 full-time employees in any calendar quarter

- Tax-exempt organizations that are not liable for the federal unemployment tax

- State and local government employers

- Indian tribal employers

How to Fill Out the 940 Form in 2023

Filling in the 940 form correctly may seem daunting, but it doesn't have to be. With the proper instructions, you can easily submit your form to the IRS and get your taxes done quickly and accurately. Here is a step-by-step guide on how to fill in and file the 940 annual tax form.

- First, obtain the correct form. You can find the form online at the IRS website. You can also download 940 form for 2023 as PDF to print out and fill in by hand.

- Second, check that you have the right form. The form you need depends on the year you are filing your taxes. Ensure you have the correct 940 federal form for the current tax year, such as 2023 or 2024.

- Third, read the instructions carefully. Before filling in the form, read the instructions that come with it. This will help you understand the form better and complete it correctly.

- Fourth, fill in the form. Enter all the necessary information, including your name, address, and tax information. Make sure you double-check your entries for accuracy.

- Finally, print and submit the form. Once you have filled in the 940 tax form, print it out and mail it to the IRS. Make sure to keep a copy of the form for your records.

Following these steps, you can easily fill in and send IRS 940 form for 2023 to the IRS. With the correct form and instructions, filing taxes can be a breeze!

Extra Instructions for the Annual 940 Tax Form

- What is IRS Form 940?

IRS Form 940 is an annual FUTA (Federal Unemployment Tax Act) return that employers must file annually with the Internal Revenue Service. It is used to report an employer's federal unemployment tax liability for the year and is usually due by January 31st of the following year. - How do I file IRS Form 940?

IRS Form 940 can be filed either online or by printing the form and mailing it to the IRS. If you file 940 online, you must register for an Electronic Filing Identification Number (EFIN) and submit your form through the IRS e-file system. If you choose to file by mail, you can obtain the blank PDF and form 940 instructions from the IRS website, fill out the form, and mail it to the address on the guideline. - Where can I find a blank IRS Form 940?

A blank printable 940 form for the 2023 tax year can be found on the IRS website. You can either download a blank PDF version of the form or you can print out a blank paper copy. You can also fill in the fillable verison to file it online. - Where can I find a sample IRS Form 940?

Form 940 example can be downloaded from the IRS website. You can download a PDF version of the form and fill it out with dummy data to get an idea of how it should be filled out. You can also find sample forms from other online sources. - When is IRS tax form 940 due for the year 2023?

IRS Form 940 is generally due by January 31 of the following year. For example, Form 940 for 2023 is due by January 31, 2024. The due date may be extended in some instances due to extenuating circumstances.

How to Fill Out the 940 Form

How to Fill Out the 940 Form

What is Form 940?

What is Form 940?

Form 940 Definition

Form 940 Definition

How to Fill Out the 940 Form Correctly

How to Fill Out the 940 Form Correctly

Form 940 and Its Alternatives

Form 940 and Its Alternatives